Saying Goodbye To The Kojo Nnamdi Show

On this last episode, we look back on 23 years of joyous, difficult and always informative conversation.

Married same-sex couples around the country celebrated their new status under federal law after the fall of the Defense of Marriage Act. And following those celebrations, many called their accountants. The new law could mean a host of changes to taxes, benefits and retirement plans for same-sex couples and their families. Locally, residents are grappling with differences in laws governing same-sex marriage in the District, Virginia and Maryland. Kojo talks with experts about some of the practical questions surrounding the Supreme Court’s ruling on DOMA.

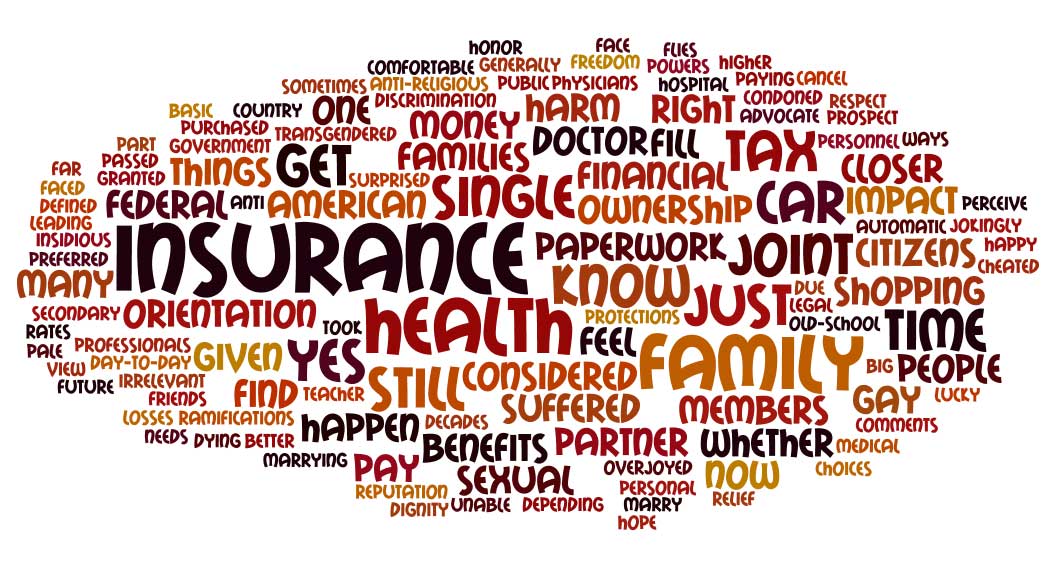

Last month the Supreme Court struck down the Defense of Marriage Act and granted the same federal benefits that heterosexual couples have to legally married same-sex couples. The ruling prompted many practical questions and concerns about implementing the rights, from insurance and taxes to adoption and marriage. As The Kojo Nnamdi Show continues to look at what comes next for same-sex couples, their families and employers, we asked listeners in the Public Insight Network how the DOMA ruling affects them.

Listeners said family issues, such as health care and car ownership, were chief among the legal, medical and financial challenges they faced as a result of existing laws governing same-sex marriage.

While the broad impact of the high court’s ruling won’t be understood for some time, individuals and families are grappling with specific questions and concerns about the decision. William N. commutes to work from Maryland, a state that recognizes his same-sex marriage, to Virginia, where he isn’t considered legally married. “It’s a very odd situation when you think about it. It’s not something that opposite sex couples really could fathom to have your marital status change just by driving to work,” he said.

Jeremy E.’s daughter, who is gay, had hoped to hold her marriage ceremony and reception all in one state. Instead, for legal reasons, the family separated the ceremony and celebration. “It would have been easier, it would have been nicer if we could do it all in one place,” he said.

Mariann S. and her partner had a civil union in Vermont more than a decade ago. Now they live in Maryland and she says as federal and state laws change it’s very confusing to navigate how the couple’s status compares to those who are legally married. “We don’t know where we stand,” she said.

MR. KOJO NNAMDIFrom WAMU 88.5 at American University in Washington, welcome to "The Kojo Nnamdi Show," connecting your neighborhood with the world. When the Supreme Court struck down the Defense of Marriage Act, married same-sex couples around the country celebrated their new status under federal law. But as soon as celebrations ended, many probably reached for the phone and called up a lawyer and an accountant.

MR. KOJO NNAMDIThe new federal definition of marriage brings up a host of complicated legal and financial questions. Once the decision came down, same-sex couples began reviewing their federal taxes and benefits, restructuring their retirement plans and wondering if the federal government will recognize their marriage even when their state government doesn't.

MR. KOJO NNAMDIJoining me now to help with answers to these questions is Nancy Polikoff. She's a professor at American University's Washington College of Law and author of the book "Beyond (Straight and Gay) Marriage: Valuing All Families under Law." Nancy Polikoff, thank you for joining us.

PROF. NANCY POLIKOFFThanks, Kojo.

NNAMDIAlso joining us in studio is Bill Abell. He's a CPA and partner of Flynn, Abell & Associates. Bill Abell, thank you for joining us.

MR. BILL ABELLThank you, Kojo.

NNAMDIJoining us from studios in Los Angeles is J.T. Hatfield Charles. J.T. Hatfield Charles is an ambassador for Certified Financial Planner Board of Standards and an adviser with Raymond James Financial. J.T., thank you for joining us.

MR. J.T. HATFIELD CHARLESGood morning.

NNAMDIJ.T., what does an ambassador for Certified Financial Planners Board of Standards do?

CHARLESWell, there's several of us, Kojo. My responsibility rose, brought in a couple of years ago with the hopes of trying to help financial advisers recognize and navigate the changes that are going on throughout planning when it comes to a lot of our LGBT community.

CHARLESSo they kind of brought me in to be that of a spokesperson to help people recognize between the 1,138 rights, obligations and protections that were taken away from us under DOMA, the Defense of Marriage Act. How can we go back and properly plan for our clients to give them the protections that weren't automatically afforded for them -- or to them, I should say?

NNAMDIOK. 800-433-8850 is our number. How do you think the recent Supreme Court ruling on the Defense of Marriage Act will affect you? 800-433-8850. You can send email to kojo@wamu.org, or send us a tweet, @kojoshow. Nancy Polikoff, most people see the Supreme Court's ruling on DOMA as pretty straightforward. But for any same-sex couple locally, it can be one huge, legal gray area.

NNAMDIA couple may be legally married here in Washington, D.C., where same-sex marriage is legal, they may reside in Virginia, where it isn't, and then they might even work in Maryland, where it just became legal. As a professor of law, what legal concerns do you see following the court's ruling on DOMA?

POLIKOFFWell, there are going to be a number of questions that have yet to be answered. There are some answers, however, to what happens in a situation like that. And I would say for the couple you're describing, if they're living in Virginia, there will be some consequences of marriage that they just don't get because their state doesn't recognize their marriage. So under Virginia law, they won't get -- if they -- they probably will not be able to divorce.

POLIKOFFThey would not have the legal consequences of divorce. They would not be each other's next of kin under Virginia state law. But if, for example, one of them works for the federal government, their marriage will be recognized for purposes of employee benefits and those kinds of things. So there are a lot of complicated scenarios.

NNAMDIBill Abell, a government report identified 198 separate tax provisions tied to marriage. Now that the Supreme Court ruling has redefined the federal definition of marriage, all of those provisions will now apply to same-sex marriages. So as an accountant, what were the first questions you went over with your clients?

ABELLWell, the first thing that most of my clients that I've talked about this with are interested in is whether it's going to save them money, cost them money, if they file jointly or file -- married filing separately. And the quick answer to that is it sort of depends because there's marriage penalties that are built into the tax code that result in higher taxes in a lot of situations.

ABELLSo the biggest first question is, what are we going to do going forward? And then the big -- the next question is what about the returns that we've already filed? We've been married for three years. Should we amend our tax returns? That's the thing that we're talking about right now.

NNAMDIJ.T. Hatfield Charles, we asked our audience to send us their questions about the DOMA ruling through our Public Insight Network. And by the way, WAMU's Public Insight Network is a way for us to reach out for input on topics we're covering. You can learn more about it at wamu.org/pin, P-I-N. Based on the many responses we received, J.T., it's clear that every same-sex couple has a unique situation when it comes to taxes, benefits and retirement. How have you been advising your clients in the days following this ruling?

CHARLESWell, it's interesting, Kojo. We have several changes that are coming into place, whether it be immediately over the course of the 25 days following the Supreme Court's ruling as of June 26. So what we have to recognize -- and you kind of led into this -- is there are so many different factors that go into any person's individual or family plan. You know, through the CFP Board, we have several disciplines of financial planning -- from retirement, to estate, to tax, to risk management, et cetera.

CHARLESWe're actually having to sit down because, as Nancy started to kind of mention earlier on, you know, from relationship recognition, what does this now mean to us as far as being able to have hospital benefits or the opportunity to maybe bypass some of the challenges of probate in the event of estate planning? What does it mean to us if we want to equalize our estates and maybe share assets or title assets in joint name?

CHARLESHow much life insurance do we need? Now that we have the opportunity to -- whether it be through the federal government to get some kind of retirement benefits or joint-and-survivor annuity pension, or whether it be other types of estate transfer without the taxation that we had before, we have to sit down with all of our clients and literally go through everything from the start again to figure out, you know, do we have enough or too much insurance?

CHARLESDo we have better protection opportunities by having someone on their spouse's employer benefits plan? So it's a whole network, and everything, unfortunately or fortunately, works together. So every discipline is cross-pollinating. You know, one simple decision about, you know, should I have something an individual name or joint name could grossly affect what happens to them as far as estate taxes, tax ramifications on their joint tax return, all the way down to just protections or transfer of assets later down the road.

NNAMDIWe're talking about what happens next in legal and financial terms in the wake of the Supreme Court's striking down the Defense of Marriage Act and taking your calls at 800-433-8850. Are you in a same-sex marriage? What options are you now considering? 800-433-8850. Nancy Polikoff, only 13 states in the District of Columbia recognize same-sex marriage as legal. So the big question underlying the DOMA ruling is, do legal same-sex marriages hold up in all states?

NNAMDIWe got one question from this, from someone in our Public Insight Network that our producer later interviewed. This person is currently legally married in Maryland. So let's listen to William's question.

WILLIAMWell, I am currently looking for a new job, and I'm finding that the more rights that I get through legalization of same-sex marriage, as well as the overturning of the section of DOMA, the more rights and benefits that I get, the less attractive it becomes to move to a state that isn't going to extend me any benefit.

WILLIAMSo, in that sense, a state that I would really like to move back to -- Pennsylvania, which is my home state -- would not provide me marriage rights either through the state or through the federal government, according to my understanding of these rulings. A state like Florida, where I have a very solid job lead, is also in a similar situation. So it -- I find it very limiting just in terms of my career choices and actually, you know, my lifestyle choices.

NNAMDINancy Polikoff, what do you say to William?

POLIKOFFSo the first thing I would say is, let's step back for a moment and talk just about being a gay or lesbian person in this country. If you're talking about where you move for a job, I think many people, even if they don't know about it, if they start to think about it, they might think, I'm an openly gay person. I want a job in a place where I can't be discriminated against on the basis of my sexual orientation.

POLIKOFFSo let's keep in mind that, although the Defense of Marriage Act has been struck down, there still is no federally-based protection against employment discrimination on the basis of sexual orientation. That's what I think of first when I think about where people are going to move for a job. And so the -- there's still a significant number of states that don't provide protection, and there's other states that do, and they do create more or less hospitable environments for people's workplace.

POLIKOFFThe other thing is there are still employers who have domestic partner policies that would give him in Pennsylvania, for example, the right to employee benefits, including health insurance benefits for his partner, for his spouse, even though the state doesn't recognize them as married. So I would say it's an individualized situation to look to. It's true that the state of Pennsylvania will not recognize him as being married for its state purposes, but that's not the beginning or the end, in my mind, of the question that a prospective employee would look at.

NNAMDIJ.T., like William says, the more rights you get, the less you want to give up. How do you counsel your clients who are looking to move out of a state that offers legal same-sex marriage?

CHARLESYou know, I feel like I'll have a better grasp on this in a couple of weeks when we see a little bit more of this rolling out. I've been -- if you're a federal government employee, the conversation keeps coming up, I think, just because of the Washington metro area. I've been very impressed with the way the federal government is handling this in their proactive efforts. Most of their systems are already in place to be able to allow same-sex spouses to be able to join on to health care or other types of federal benefits.

CHARLESSo they've actually been very proactive from that standpoint. We have to also recognize that a lot of this, I think, we'll understand more in a couple of weeks. We have two different rules of thumb. We have state of domicile or state of celebration. State of domicile is what state do you live in versus state of celebration, which is what state did you actually get married in? And the federal government -- and if you think about what state did you actually get married in, it makes the opportunity of getting additional federal benefits greater.

CHARLESSo, in other words, if I got married in the state of Maryland, I work for the federal government, and the federal government recognizes state of celebration, then it doesn't matter what state I live in across United States. I'm going to have all of those benefits that come under the federal government. So we have certain things that are based on state of domicile like Social Security benefits, as well as the IRS, so anything dealing with the tax code.

CHARLESAnd then we have state of celebration, which is more geared towards immigration status, things along those lines. So what we're understanding now -- and, Nancy, please chip in if I'm going off-kilter on this, but my understanding is, if we have state of celebration -- and that's what the government is doing -- we have greater opportunity to be anywhere and get the benefits.

CHARLESIRS and Social Security -- my understanding is the IRS has the ability to change from state of domicile to state -- or state of residence to state of celebration without any act of Congress. It's just a matter of changing policies and procedures within their world. So, long term or over the next two weeks, I think we're going to have a greater understanding of what benefits are going to be available to us as we're going across different state lines.

CHARLESI guess, Kojo, to go back to your original question, though, what types of things should we be doing or what considerations should we have, well, if we're going to be living outside of a state that recognizes our same-sex marriage, until we have a true understanding of what's going to happen as far as federal government protections, we still have to make sure we have the ancillary protections in place, whether it be estate planning or different tax-paying strategies.

CHARLESAnd again, I kind of tie this is in, make sure you're working with a qualified financial adviser who's coordinating this with the attorney and the CPA to make sure that everybody is working together and taking all these disciplines into account.

NNAMDIBill Abell, when your clients move from a state that allows same-sex marriage to one that doesn't, what complications do you think that creates for their finances?

ABELLWell, from a tax standpoint, they've already faced weird complications in their tax returns in that if they've been married in a state that recognizes same-sex marriage over the last several years, they've had to file separate single federal tax returns and then do sort of a mocked up joint tax return in order to be able to do their state income tax return.

ABELLNow -- so clients that have now moved out of a recognition state into a state that doesn't recognize their marriage is going to be assuming for the moment that the IRS is going to recognize their marriage, which I'll come back to. They're going to need to file joint -- a joint federal return and then separate safe return. So they have sort of an opposite pickle, which is just sort of a big administrative hassle and, of course, cost them money to do.

NNAMDIYou said you would come back to assuming that the IRS is going to recognize their marriage.

ABELLYeah. And I think the IRS, J.T. mentioned, it's the standard under the IRS rules is the -- has typically been the state of residence for determining where -- whether a marriage is recognized. That is regulatory based, not based on statute. So they can come out with a rule that they'll recognize the state of celebration as the key to whether or not a marriage is recognized. I can understand how they can do it differently.

NNAMDICan you clarify for our listeners what the state of celebration is?

ABELLThe state of celebration is the state where the marriage occurred. So if someone goes to one of the 13 states...

NNAMDIGot you.

ABELL...or to the District of Columbia and gets married, that's the state of celebration. If they then move to Pennsylvania, for instance, Pennsylvania isn't going to recognize it. But I have a hard time administratively seeing how you could say, OK. On this day then, you stop being married for federal income tax purposes. It would be sort of a huge administrative hassle.

NNAMDIHere is Suzanna in Manassas, Va. Suzanna, you're on the air. Go ahead, please.

SUZANNAHi there. Yes. Thank you so much for taking my question. I was calling -- we recently married. I live in Manassas. I have family here. We went to D.C. and got married. Ideally, I would like stay in Virginia. However, I'm obviously concerned. I know you guys already mentioned the next of kin is not recognized in Virginia, and that bothers me.

SUZANNASo I'm also -- we're looking at -- we're looking at buying a house and obviously settling somewhere. We're looking at D.C., Maryland and Virginia. I'm wondering how that will that affect things. Number two, I'm also wondering about children and adoption. And if, for example, I chose to have a child by my body and how it would work for with my partner to adopt and also even, say, we looked at international adoptions and how that would affect, if it affects at all, depending what state we live in.

NNAMDINancy Polikoff.

POLIKOFFOK. So parentage -- the first thing to tell you about parentage is parentage determinations are separate determinations from your marital status. If you live in Virginia and you have a child, my recommendation to you would be to have the child born in the District of Columbia, which is pretty easy to do. Just go to a doctor here, and that becomes -- a hospital here will be where the child is born.

POLIKOFFUnder D.C. law, you will both be the parents of the child. You will get a birth certificate that has both your names on it, and then you will actually be able to go into court in the District of Columbia to obtain a court order that says you are both the parents of the child. And Virginia will have to respect that. So Virginia will not respect your marriage. They will not consider the two of you married to each other. But you absolutely can take advantage of the District of Columbia parentage laws to ensure that your child has two legal parents.

NNAMDIAnd, Suzanna, before we go, I'd like you, J.T., to talk a little bit about Suzanna talking about living in Virginia and thinking about where they're going to move because a person legally married to someone of the same-sex in Maryland may be driving into the state of Virginia each day. And we talked about the Virginia laws and next of kin. How would that state's laws affect that person even when they don't reside in it if, for instance, they had an accident and had to be hospitalized?

CHARLESIt's a great question. That actually happened to a couple of buddies of mine. Suzanna, let me go first back to the original -- the basis of the question, so living in Virginia. Obviously, in the commonwealth of Virginia, we have very Draconian laws. In other words, any affect that you might have as far as the relationship with you and your partner, well, we have to kind of recognize that Virginia's going to treat you as nothing more than legal strangers.

CHARLESSo a second cousin twice removed theoretically would have greater protections under the law than your spouse of however many years would have. So that's step one. So what do we have to do? Well, we have to work with our own tax advisors, our attorneys, our certified financial planners to make sure that we're coming together with a plan to give you guys the same protections that you're not afforded under the law.

CHARLESSo I had a couple of buddies that lived in the District of Columbia, married by all rights or had all the recognition of same-sex marriage, went into Virginia to do some grocery shopping or something and got in a car accident. One of the two was significantly or seriously injured, ended up in the hospital. The partner, being nothing more than a legal stranger in the eyes of the commonwealth of Virginia, couldn't get any type of basic information as far as the status of his spouse, if you will.

CHARLESSo he had to end up calling his spouse's mother who was estranged from them because she didn't recognize their marriage or their union. She eventually came to the hospital but basically blocked him from getting any type of information with regard to the medical status. So it wasn't until the partner recovered or came or had some type of cognitive ability that he was actually able to come into the room and get any type of basic information.

CHARLESAnd there was actually another case out in Kansas City or Missouri recently where a hospital basically failed to look at the medical directives that were on file. So even though the spouse have been together for five years and had their appropriate medical documentation, the hospital basically refused any type of visitation because a family member stepped in.

CHARLESSo it's more than just doing the comprehensive planning. Obviously, that's a great first layer. But we also have to recognize, again, that in the commonwealth of Virginia or other states -- I think there are 30-plus states out there that have Draconian laws or anti-legislation -- that you have bigger implications that you have to be aware of.

NNAMDINancy.

POLIKOFFSo speaking of the bigger issue, I would just say about that issue, every single person who writes a medical power of attorney or advanced directive is entitled to have it recognized. It doesn't have anything to do with being gay. It doesn't have anything to do with being married. If you select your close friend to be the person who makes those decisions for you, the hospitals are required to follow that.

POLIKOFFNow, I understand they don't always, but that's not a problem that married same-sex couples face alone. That's a problem that anybody faces who isn't having their wishes respected when they're hospitalized.

POLIKOFFAnd a lot of the things we're finding out now as couples are seeing the difference what it is to be treated married and unmarried under the law is how little sense it makes to have these rigid distinctions in law that two people whose lives are exactly -- two couples whose lives are exactly the same in every respect get treated differently under a number of laws, whether they have actually formalized that relationship in marriage or not. So those are some bigger issues to think about when we're talking about that.

NNAMDISuzanna, thank you for your call. We've got to take a short break. If you would like to call us, it's 800-433-850. Has your family faced any challenges because of current laws on same-sex marriage in Maryland, the District or Virginia? 800-433-8850. You can send us email to kojo@wamu.org. Send us a tweet, @kojoshow. Or go to our website, kojoshow.org, join the conversation there. I'm Kojo Nnamdi.

NNAMDIWelcome back to our conversation. The Defense of Marriage Act is gone. What's next? We're talking with J.T. Hatfield Charles. He's an ambassador for Certified Financial Planner's Board of Standards and an advisor at the Raymond James Financial. He joins us from studios in Los Angeles.

NNAMDIHere in our Washington studio is Nancy Polikoff. She is a professor at American University's Washington College of Law and author of the book "Beyond (Straight and Gay) Marriage: Valuing All Families under Law. " And Bill Abell, he's a CPA and a partner of Flynn, Abell & Associates. You can call us at 800-433-8850. Here is Carl in Reston, Virginia. Carl, you're on the air. Go ahead, please.

CARLThank you, Kojo. My question has to do with immigration. As I understand it -- I may be wrong. But as I understand it, if you want to marry a heterosexual person who is overseas, you need merely to demonstrate to the State Department -- I don't know exactly how you do this. But you need to demonstrate to them that, yes, you are intending to marry this person.

CARLAnd it is an easy thing than to bring this person into the country for that purpose. What I'm wondering is, does the change that the Supreme Court brought about have any effect on this, in other words, if it were a same-sex potential spouse overseas?

NNAMDIWould the same procedure apply, Nancy Polikoff?

POLIKOFFThe short answer is yes. The -- for immigration purposes, the place of celebration is the place that determines whether you're married for purposes of sponsoring your spouse. Now, what the caller is talking about is essentially a fiancé visa. And I am thinking that the government will have to issue regulations about that for people who are living in states that will not allow the marriage there since, presumably, if they're going to stick with celebration, the person would have to show they were going to marry their fiancé in a place where it was allowed.

POLIKOFFBut for the fiancé visa specifically, I haven't seen any guidance on that. So we'll be waiting specifically for regulations. But if you're already married in a place where it was legal to do it, there's no question that your spouse -- your person will be treated as a spouse for immigrational (sp?) purposes.

NNAMDICarl, thank you very much for your question. Bill Abell, one person in our public inside network asked whether the federal benefits of marriage will end up being better for their finances or not. Joe is currently in a domestic partnership with his partner here in Washington, D.C. Let's listen to his concern.

JOEThe difficulty for myself and my partner, we're serodiscordant couple. He's been HIV-infected for 28, 29 years, and he lives on Social Security disability. I work in a non-profit, and so I don't make a lot of income. And if we get married and we get all the federal benefits, he winds up losing some of the benefits he gets because the government will be -- both the district and the federal government will be looking at our combined income.

JOEWhereas right now, they just look at his income, and he gets these additional benefits. He doesn't have to pay the premium on his Medicare B or D. He doesn't have to pay copays when goes to the doctor. It would be a big financial burden, I think, and I haven't worked out the numbers if it would all balance out once we get the federal benefits, that maybe it wouldn't be so -- so that's my big concern right now. Will this create more of a financial burden for us?

NNAMDIBill, will marriage end up being more costly for Joe and his partner, or we got to run the numbers?

ABELLWell, the -- well, you certainly have to run the numbers because it's different for everybody. But the likelihood is -- from what Joe described from an income tax standpoint, he'll probably -- they would probably be better off married than not. They'd probably save money from filing jointly as opposed to filing as single people.

ABELLNow, as it relates to eligibility for those benefits, I'm not certain -- I think he said that they're registered as domestic partners in the District of Columbia, which I think I understands -- and they're living together presumably and living in a mutually supportive environment, I'm not sure that that doesn't already qualify you as as...

NNAMDIJ.T.?

CHARLESYeah. That's -- this is a really interesting question. And, unfortunately, I think I need a little bit more of the details in order to formulate.

NNAMDIYeah.

CHARLESFrom a tax perspective, I see what Bill is saying as far as the benefits of doing a joint return and the blending of income. I can see where the benefit with that is. As far as the Social Security aspects of it, I feel I need to tie that into a little bit more detail to figure out truly what they might be gaining or giving up by having the federal benefits.

CHARLESI'm not seeing anything that just jumps out of -- out -- I'm sorry -- that jumps out of me as a great benefit right now of marriage for the two of them other than potentially, if they have a joint household, getting some Medicaid protection as far as if they were to deplete assets, just as far as being able to preserve the house in the event that they had to spend down all of their assets, that might actually be able to protect some of the income of the working spouse.

NNAMDIOK. Here is Diane in Arlington, Va. Diane, you're on the air. Go ahead, please.

DIANEYeah. Hi. Thanks. I want to go back to the issue of state of celebration. If that does become the standard for the IRS or for anything else, how would that apply for those of us who were married -- legally married outside the U.S.? For example, we were married in Canada.

NNAMDINancy Polikoff?

POLIKOFFIt would be place of celebration rather than...

NNAMDIState.

POLIKOFF...state of celebration. So, in fact, in the Windsor case itself, the case that led to the overturning of DOMA, that couple was married in Canada.

NNAMDIOK. So, Diane, thank you very much. J.T., the Office of Personal Management announced that federal benefits would apply to same-sex spouses of federal employees. How exactly will federal benefits make a difference for their finances?

CHARLESWell, everything from health care to availability -- OK. So I've got two clients that live in Alaska. Prior to DOMA being repealed, one of them is fairly high level on-base. He is one of the required personnel. So he's required actually to live on base. His spouse -- they seemed married. His spouse is a civilian so does not have access to the base for all -- housing, travel allowance, things along those lines.

CHARLESThey actually had to go back and get an approval or a special waiver, if you will, to be able to have his spouse actually live with him on base. Things like that are going to -- are no longer going to be an issue. Medical benefits: A spouse, the children of a legally married couple, stepchildren will now be -- now have access to any of the medical benefits.

CHARLESFamily Leave and Medical Act will now be available for the same-sex spouse or the children thereof. Pensions, this is a huge item. So now, we have all these active duty military who have been working to serve our country and protect us. Their same-sex spouses will now have the opportunity to get a joint and survivor pension benefit should their spouse predecease them.

CHARLESAnd that will be huge in retirement planning and will actually probably affect a lot of what these individuals would have otherwise had to cover in life insurance to protect against that -- not being there. They'll actually now have that joint and survivor annuity benefit, just to name a few items.

NNAMDIHere's Abby in Silver Spring, Md. Hi, Abby.

ABBYHi. Thanks for taking my call.

NNAMDIYou're welcome.

ABBYI am legally married -- was legally married in D.C. to my wife two years ago. And then as of Jan. 1, of course, I became legally married in Maryland, and I'm now able to be -- to receive medical benefits on my wife's medical insurance plan. But up until now, she has to pay taxes to the federal government on the insurance benefits that I receive. I understand that now that DOMA, you know, being won, that you don't have to pay those taxes. And I guess I'm wondering when that goes into effect?

NNAMDIWonder no more. Here's Bill Abell.

ABELLYeah. That should go into effect immediately. It's a little unclear whether it's going to be retroactive, but there may be the same opportunity. So she's been including these wages, essentially additional wages, in her income for the last, however, two years that you've been married for your benefits, as well as her employer has been paying their share of the payroll taxes on that.

ABELLBoth of them potentially have a claim for that money back because nobody should have been taxed on that money. And the employee shouldn't have been taxed on that money, and the employer themselves shouldn't have been taxed on their share. So potentially -- and again, it's unclear -- and I suspect the IRS will soon issue guidance on this. But potentially, there's money to be claimed on both sides there.

NNAMDIAbby, thank you for your call.

ABBYSure. Thank you.

NNAMDIWe got an email from Mark in D.C., Nancy Polikoff, who says, "My partner and I in the District are debating whether to get married or enter a registered partnership. The main impact of the DOMA decision for many comes down to income tax filing status and a state tax exclusion for a spouse. My partner and my incomes are such that they would -- that we would be subject to the marriage tax if we married.

NNAMDIHowever, registered partners in D.C. can file their D.C. returns as either single or married, and they enjoy the same spousal exclusion on estate taxes as married couples. Since the USG even after the defeat of DOMA -- the U.S. government that is -- does not recognize the concept of registered partnership, D.C. registered partners would also be able to file their federal tax returns as single thereby avoiding the marriage penalty.

NNAMDIFew gay married couples would benefit from the federal spousal exclusion from estate tax because few have assets that exceed the 5.25 million exclusion that everyone gets regardless of marital status. So my partner and I are leaning towards a registered partnership. Do you see any flaw in that logic?"

POLIKOFFI think that if you're just looking at each of the things he raises, actually, the logic is perfect because his information is correct. One of the things in general that we don't know about yet is how -- whether the federal government is going to issue some guidance concerning the status of domestic partnership or civil union under state law when it is treated -- under federal law when it is treated identically under state law.

POLIKOFFThe one thing I will say about it, but this isn't the final word, is that there was a sort of low-level opinion out of the IRS -- and Bill may know more about this than I do -- that a heterosexual couple in an Illinois Civil Union where heterosexuals can enter them just as in D.C. heterosexuals can enter registered domestic partnerships, there was an opinion out of the IRS that that couple needed to file their federal taxes as married because they were treated as married under state law.

POLIKOFFIf that actually becomes the overall regulation from the federal government, then being registered domestic partners in D.C. will not get them out of filing their taxes jointly for federal purposes. But we're still waiting.

NNAMDIGot to take a short break. When we come back, we'll ask what all of these means for civil unions. You can call us at 800-433-8850. What will the Supreme Court's ruling on DOMA mean for you in the long term? Will it affect what job you take or what state you move to? 800-433-8850. I'm Kojo Nnamdi.

NNAMDIIn the wake of the Supreme Court striking down the Defense of Marriage Act, we're talking about what's next for couples involved in same-sex marriage or considering same. We're talking with Bill Abell. He's a CPA and partner of Flynn, Abell & Associates. Nancy Polikoff is professor at American University's Washington College of Law. She's also author of the book, "Beyond (Straight and Gay) Marriage: Valuing All Families under the Law."

NNAMDIAnd J.T. Hatfield-Charles is an ambassador for Certified Financial Planner Board of Standards and an advisor with the Raymond James Financial. 800-433-8850 is the number you can call. We got a tweet from @bornsikh (sp?) who said, "My partner and I are legal domestic partners in D.C. Does this count as marriage under the new federal change? Do we file together?" Bill.

ABELLWell, currently, as Nancy was saying before the break, there has been some sort of regional guidance out of the chief counsel's office of the IRS in Illinois that, at that time, an opposite sex married -- I'm sorry -- an opposite-sex registered domestic partner couple in Illinois had all the rights and benefits of marriage and, in fact, were therefore to be treated as married for federal income tax purposes. I do not know if that holds true for the District of Columbia. I'm not aware of it having held true, but that doesn't mean that it will not.

NNAMDIAnd a woman named Mary Ann responded to our public insight network with a question about the legality of her civil union. Let's listen to her question.

MARY ANNMy partner and I had a civil union in 2001 in Vermont, and it seemed fairly straightforward at the time. But it's gotten a lot more confusing as the laws of change and the rules of change. We live in Maryland. And now with DOMA changing, you know, obviously having federal benefits is a big issue. And we don't know where we stand in terms of whether the civil union gets rolled over and defined as marriage whether it needs to be dissolved in some legal way before we could get married legally.

MARY ANNSo there are a lot of confusing issues. And I've done some Internet research looking into Vermont and their laws, and it's not clear anywhere. So I really have a hard time getting information. And, of course, with DOMA being overturned, now it's even more confusing.

NNAMDINancy Polikoff, can you clarify?

POLIKOFFI can clarify some of it. So under Vermont law when they started to allow same sex couples to marry, they eliminated civil unions going forward. But their law said that if you were in a civil union beforehand, your civil union would remain intact. Now in the District of Columbia, if you lived in the District of Columbia, your civil union would be recognized as a registered domestic partnership in the District of Columbia, which would entitle you to all the state or D.C.-based consequences of marriage.

POLIKOFFMaryland has marriage equality, but it never had a state-wide domestic partnership for civil union status. And as far as I know, there is no indication that Maryland would recognize a Vermont civil union and consider you married under Maryland law although someone may try to make that argument at some point.

POLIKOFFFor anyone who's been married or in a civil union or domestic partnership in any New England states, the best resource for finding out that information is on the website for GLAD, Gay & Lesbian Advocates & Defenders, which is just glad.org because not every state has done the same thing. For some people in civil unions in some states, they're now automatically married if they didn't opt out. So it is very state by state.

NNAMDIJ.T., according to the human rights campaign, more than half of Fortune 500 companies offer benefits to same-sex couples. Is there a sense of what the Supreme Court ruling may mean for private employees and their benefit plans for same sex couples?

CHARLESMy hope is that they will trend it to be more favorable. Very exciting, as Bill was kind of alluding to earlier, we no longer have the imputed tax on different healthcare benefits whether it would be for different types of life insurance, health insurance or disability for spouses or kids as part of same-sex couples. So that was a nice provision that went away.

CHARLESNow with the federal government actually coming back and offering these benefits on the grand scale for all of their civil service employees as well as active-duty military, part of that being the pensions with the joint and survivor annuities, I'm very hopeful -- or I'm very optimistic that we're going to see a lot more private companies come out with these types of protections for their same-sex couple employees.

CHARLESWe actually have several out there that have already kind of been ahead of the curve. But obviously, it's expensive for these companies to make these changes. So very hopeful, very optimistic, and I think they're going to take the lead with the federal government.

NNAMDIOn to Virginia in Washington D.C. Virginia, your turn.

VIRGINIAHi. Thank you. It's very interesting to listen to your conversation. I wanted to go back and to talk a little bit more in depth about healthcare directive, advance directive. I worked the practical side of it. I've served as a clinical ethicist. And in a hospital, I've gotten these documents from patients.

VIRGINIAAnd I think we're really missing in this conversation today an important consideration that it's critically important for all people -- domestic partners, same-sex partners, married people, young people, whatever -- to identify, first and foremost, who's going to speak for them if, for some reason, they become incapacitated because your presenter has indicated that the challenge was here, your partner is unable to speak, they're in a coma or some ungodly thing has happened to them, and you can't get in.

VIRGINIASo I want your callers to know this: Create your healthcare information. It's online. You can (unintelligible) and what you want to do is give it to your family practitioner to put it -- you want it on file at the hospital community that you're likely to go to. You want one in the glove box of the car. And you want one in or on the refrigerator so that if, God forbid, you have to go the hospital and say, Hey, I'm my partner's spokesperson, you've got your document in your hand because most times when people are in (unintelligible) their primary physician is always contacted.

VIRGINIASo there's a document there. You've got one in your hand. And if they don't listen to you, you ask for an ethics consult. All hospitals that are Joint Commission accredited are required to have an ethics panel or group available. Get your voice heard. And these are the steps to make that reality for everybody.

NNAMDIVirginia, thank you so much for sharing that with us. The only thing we can say to that is, yes, good advice. J.T., the Defense Department says it will extent military benefits to married same-sex couples, meaning their families would have access to benefits like medical care or housing. How will the DOMA ruling affects service members with the same-sex spouse differently than civilian same-sex families?

CHARLESSay the question again. So we're talking about active duty versus civil service?

NNAMDINo. We're talking about active duty versus, I guess, people who are not in the service at all, who are not in the military.

CHARLESOK. So general civilians in private industry...

NNAMDICorrect.

CHARLES...versus those who are either government service employees or active duty.

NNAMDIRight.

CHARLESSo different types of benefits that are, I guess, privy to the active duty or the civil service would be base visitation, the different retirement strategies, whether it'd be TSP, CSRS, FERS, FEGLI, which is the life insurance component, all the way down to the long-term care benefits that are available to all military personnel.

CHARLESSo if we're talking about just civilians in general, private industry, they're going to be privy or they will have available to them anything that they're corporate -- corporations or companies offer. If they're self-employed, obviously, there's different types of protections or investment strategies, retirement plans that they can set up for themselves. It is...

NNAMDIBut also talk about, J.T., where military families are considered residents as opposed to where civilian families are considered residents.

CHARLESYeah. I kind of started off the conversation with this at the beginning of the hour. I've been very impressed. I've got some clients at the Pentagon in very high level that were very active in the repeal of "don't ask, don't tell" and now very involved with setting the precedent and regulations or policies that are going in to getting the new procedures going. They've been very proactive. But across -- I can't say across the board, but everything that I'm reading and everything I'm seeing, the military is really going back to state of celebration, which is the most beneficial for same-sex couples.

CHARLESWhatever state I get married in, those are the rules and regulations. They're going to follow me whether I live in a state that recognizes my same-sex marriage or whether I live in one that does not. So under the federal government, as long as we get across-the-board protection with state of celebration, it doesn't matter what state these individuals live in as long as they got married in the state, obviously, that recognizes their marriage. They will have protections anywhere they go, which is huge.

NNAMDIOn to Vanessa in Annandale, Va. Vanessa, you're on the air. Go ahead, please.

VANESSAHi. I just wanted to point out that where you actually decide to retire is very important in your state planning. My father died three years ago. And his partner of 30 years had to pay 14.5 percent of state tax on all the moneys he received, while I, as his daughter, only had to pay 4.5 percent of state tax. He had to pay three times what I received, and that's going to really affect him long term. He won't have as much money to be living on. My father was the primary breadwinner and was a federal employee. Well...

NNAMDIJ.T., before the Supreme Court ruling, some retirement strategies were only open to opposite-sex couples. What parts of their retirement and long-term financial plans should same-sex couples review? One part of it I think Vanessa just referred to, didn't she?

CHARLESWell, yeah. And actually, I'm going to take that a step further. So we're looking at either retirement pension plans, which are basically a payment for life over the individual's lifetime. Now, with same-sex marriage being -- I'm sorry -- being recognized by the federal government, we actually will have the opportunity to get a joint and survivor annuity for that surviving spouse. OK, that's part one and that's a great opportunity.

CHARLESThe second thing with that that was interesting, Vanessa, is your father's partner will now have the opportunity, you know, prior to DOMA being repealed, when your father passed away, he's retirement accounts would had have been either distributed over a short term, several years, or potentially put into something called a stretch, or you might have heard of something can called inherited IRA, which allows your father's partner to actually take those distributions over the course of -- the rest of his lifetime.

CHARLESNow, we actually have the opportunity -- and this is another major improvement -- where we can take -- or your father's partner would have been able to take that retirement account, and instead just deposit it or transfer it over to his own retirement account and not been forced to take almost immediate distributions, which obviously is going to create even more taxation for him. He would have instead been able to defer those distributions until he was actually ready to use that money for his own personal needs.

NNAMDII'm afraid that we're almost out of time, Nancy, but the patchwork of state laws governing same-sex marriage seem to get even more complicated when it comes to divorce. A married same-sex couple might seek a divorce in a state that doesn't even recognize their marriage. What challenges would they face in that situation? You have about a minute left.

POLIKOFFYes. You are actually right about that. And so some jurisdictions and the District of Columbia and Delaware in this area are two of them. Where if you marry in the District of Columbia or Delaware, those jurisdictions will divorce you even if you don't live here anymore or never lived here. That isn't true.

POLIKOFFAnd there are many same-sex couples who married some place and have never lived any place that recognize that marriage who need to seek -- if they want to divorce and can't easily, they need to go to lawyers who know this area of law to figure out what they can do because they absolutely are considered married in some jurisdictions and not in others, which is confusing at the least.

NNAMDIAnd I'm afraid that's all the time we have. We do have extra audio content on our website that you can listen to on -- about this issue at our website, kojoshow.org. Nancy Polikoff, thank you for joining us.

POLIKOFFThank you very much, Kojo.

NNAMDINancy Polikoff is a professor at American University's Washington College of Law and author the book "Beyond (Straight and Gay) Marriage: Valuing All Families Under Law." Bill Abell, thank you for joining us.

ABELLYou're welcome, Kojo.

NNAMDIBill is a CPA and partner at Flynn, Abell & Associates. J.T. Hatfield Charles, thank you for joining us.

CHARLESThank you, Kojo.

NNAMDIJ.T. is ambassador for the Certified Financial Planner Board of Standards and advisor with Raymond Jones Financial. I'm Kojo Nnamdi.

On this last episode, we look back on 23 years of joyous, difficult and always informative conversation.

Kojo talks with author Briana Thomas about her book “Black Broadway In Washington D.C.,” and the District’s rich Black history.

Poet, essayist and editor Kevin Young is the second director of the Smithsonian's National Museum of African American History and Culture. He joins Kojo to talk about his vision for the museum and how it can help us make sense of this moment in history.

Ms. Woodruff joins us to talk about her successful career in broadcasting, how the field of journalism has changed over the decades and why she chose to make D.C. home.